NewRez is pleased to announce an exciting addition to the Smart Series product menu with the introduction of the SmartEdge 1-Year Income option for SmartEdge!

This new enhancement provides self-employed borrowers and wage earners an option to qualify using one year of income documentation.

Highlights

- Same eligibility and guidelines as SmartEdge

- SmartEdge 1-Year Income Documentation Requirements:

- Wage Earners

- Paystub with most recent 30 days YTD earnings and most recent year W2

- Bonus, overtime, and/or commission income is not permitted with 1-Year Income

- Self-Employed Borrowers

- Most recent year filed personal and business tax returns for all businesses owned with all applicable tax schedules. Current year extensions are not permitted. Business(es) used for self-employed qualifying must be two or more years old

- Other sources of supplemental income such as rental income, dividend/interest income, capital gains, alimony, child support, pension or retirement are not eligible for 1-Year Income documentation

- Borrowers who have provided two years of income documentation are not eligible to utilize 1-Year Income for qualification

- Wage Earners

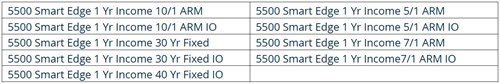

- When using 1-Year Income documentation the following products should be utilized.

Please reference the Product Profiles page for full details of the changes outlined in this announcement.